A little over 4 years ago, Ken and I came together to found CRIMSON and shortly thereafter launched the CRIMSON Capital Growth Fund that is focused on high-quality, well managed US small cap companies. For Active Investors we believe – and the historical data attests – that US small cap represents one of the single-most attractive asset classes in the public markets where investment talent and experience, combined with rigorous proprietary research, provide a disciplined and nimble Investor – such as CRIMSON – with a sustainable competitive advantage.

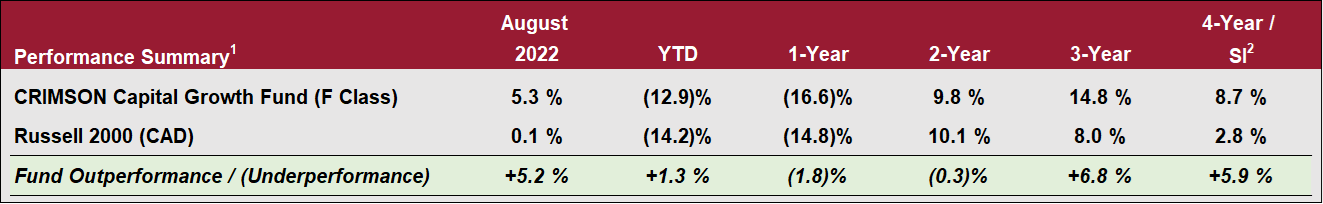

4 years later we are proud to share that the CRIMSON Capital Growth Fund has delivered some of the strongest returns for Investors in the US small cap area outperforming the Russell 2000 benchmark by +590 bps or +5.9% net of all fees and expenses on an annualized basis over that period of time. The summary of the performance of the CRIMSON Capital Growth Fund since inception is highlighted below.

As we shared in our most recent Letter to CRIMSON Investors, the CRIMSON Capital Growth Fund represents excellent value for investors today with a margin of safety just under 50%, the highest since the Fund’s inception. Furthermore, if every investment in the Fund’s portfolio were to theoretically reach its intrinsic value 3 years from now, the compound annual return would be in excess of a staggering 28%! In Ken and my investment careers, portfolio valuation levels of this nature, without exception, have led to excellent future long-term returns to investors.